Big advances have taken place in transportation during the month of October in American history. There were cars, and ships, and rockets—oh my!

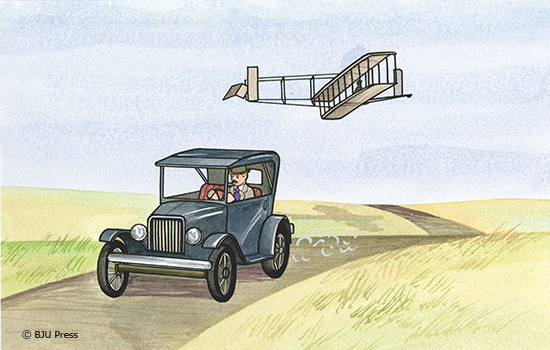

October 1

The Model T was introduced by Henry Ford in 1908. It could go as fast as forty-five mph! For almost twenty years, this cheap, reliable car dominated the auto industry because of the increase in car production as a result of the assembly line. See how the “Tin Lizzie” impacted transportation in America.

October 4–10

This week is Fire Prevention Week. Teach your kids fire safety and preparedness with these activities from Sparky the Fire Dog®. It’s also a good idea to practice what everyone in your family should do if your house catches on fire.

October 11

Apollo 7 launched into space on this date in 1968 with astronauts Schirra, Eisele, and Cunningham on board. It was the first mission to fly after the fatal Apollo 1 accident and kept us on track for reaching the moon. The space flight lasted ten days and twenty hours. During part of that time, the first live television broadcast from space was recorded. Take some time to explain an astronaut’s rocket launch and reentry process to your kids with this Space Coloring Page created by a BJU Press illustrator. My favorite picture is the parachute one!

October 12

Columbus Day is named after the explorer Christopher Columbus, who ironically never reached the North American mainland. So what’s important about today? Don’t Celebrate Columbus Day offers a biblical lens through which you can discuss the actions of Columbus with your kids.

October 19

In 1781, the British surrendered at Yorktown, recognizing that the Americans had won. This event formally ended the American Revolutionary War, but some fighting did continue until 1783. Without the support of French troops and warships allowing Washington’s total forces to trap the British in Virginia, the battle could have turned out quite differently!

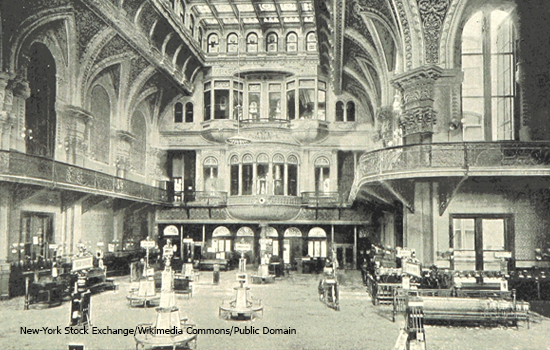

October 29

The Stock Market crashed on “Black Tuesday” in 1929. Prices on the market continued to decline for three years during what we now call the Great Depression. During this period of time, millions of people lost their jobs and had little money for food and other necessities. There were many factors that contributed to this financial crisis in our nation’s history. Find four simple ways to teach financial lessons to your kids so that they can make good choices now and in the future.